Retirement Plans for REALTORS®: How Real Estate Agents Retire Rich

REALTORS® are in the business of handing off clients and real estate investors the keys to their own kingdom; but what about themselves? When it comes to retirement options, REALTORS® deserve their own piece of the pie. So, what are the best retirement plans for real estate agents?

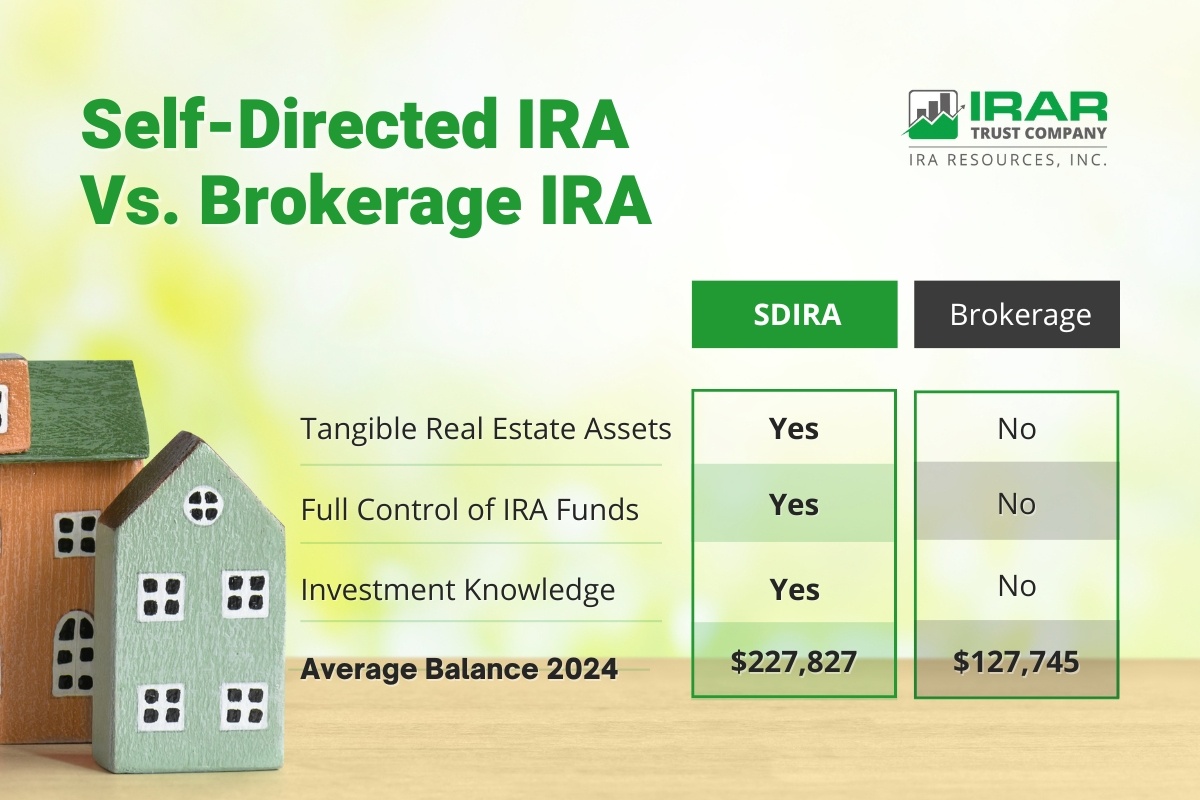

Self-directed retirement plans offer an alternative investment strategy that can outperform any employer-sponsored plans. By using a self-directed individual retirement plan (SDIRA), REALTORS® are able to put themselves in the best position financially to secure a richer retirement. Let’s take a look at the advantages of a self-directed real estate agent retirement plan.

At the beginning of January 2022, The National Association of REALTORS® reported that single-family home prices nationally rose 15.7% year-over-year. Real estate agents are in a unique position to use their own insight to plan for retirement.

How do Real Estate Agents Save for Retirement?

It makes sense for REALTORS® to save for retirement by leveraging an industry they know well: the real estate industry. Take for example members of the California Association of REALTORS®. In Q1 2022, the average client account was 63% larger than the average IRA at Fidelity, $127,100.

Perhaps that's because they are investing in what they know best— real estate. They have knowledge in the investment, passion, and experience. They also come across the best deals first. And while some investors' retirement portfolios take a hit in the stock market, these agents are super charging their own.

REALTORS® are usually sole proprietors, or established LLC, C, or S corporations. They have the ability to optimize their retirement savings because they have small businesses allowing them to save more.

Many REALTORS® are self-employed because it gives them the ability to control the course of their future and daily lives. They like the freedom of making their own schedules. Operating an SDIRA gives REALTORS® the power to shape their financial destiny and have the control that they are accustomed to.

Besides real estate there are many other investment options allowed in self-directed IRAs like, private equity, precious metals, etc. This helps them diversify their assets even further.

What Retirement Plans are Available for REALTORS®?

SDIRAs give REALTORS® more freedom to invest in alternative asset types like real estate. Commonly referred to as a real estate IRA, this type of SDIRA makes real estate one of many possible asset choices. That is a big advantage over an employer-sponsored retirement plan and brokerage IRAs (Fidelity, Schwab, Wells Fargo, etc.)

Being self-employed also allows access to a variety of retirement savings plans. Some of the most popular retirement plans for self-employed REALTORS® include Solo 401(k) plans, Simplified Employee Pension (SEP) IRAs, and self-directed IRAs (SDIRAs.) Some of these accounts also allow bigger contributions annually. Although a Traditional IRA and a Roth IRA are not for small businesses, we do see a lot of REALTORS® choosing these as well.

SDIRAs give REALTORS® more freedom to invest in alternative asset types like real estate. Commonly referred to as a real estate IRA, this type of SDIRA makes real estate one of many possible asset choices. That is a big advantage over an employer-sponsored retirement plan.

To establish one of these self-directed retirement plans for REALTORS®; they will need a financial institution or IRA custodian that will allow real estate as an investment.

What are the Advantages of a Self-Directed Real Estate Retirement Account?

Besides being able to buy real estate, here are several other benefits of a self-directed realtor retirement plan for self-employed real estate agents to consider:

Reliability

Realtor retirement statistics support that the real estate market has been historically more reliable compared to the stock market which can exhibit instability and uncertainty. This tax-advantaged, low-risk investment opportunity comes with a variety of options like direct property purchases, property leveraging, holding interest in an LLC, and more. You can select any type of real estate-related investment that falls within this asset class to grow your retirement savings.

Profitability

A real estate IRA offers substantial tax benefits. Purchasing real estate can generate rental income that is tax deferrable. Taxes are generally delayed, but only if the income received remains in your retirement account.

In the long run, this can help SDIRA account holders earn much more through their real estate investments. This allows your retirement savings to grow unencumbered. Income received from a rental property can be a type of consistent retirement income that boosts your savings throughout the rest of your lifetime.

Financing

A self-directed retirement account for real estate investing can get a loan. By renting the IRA property, the IRA receives rental income to pay off the non-recourse loan— a loan made to the IRA. If your plan is to live in the IRA-owned property, you’ll need to distribute the property from your IRA before making it your new home.

If you don't distribute the property before moving in, you will be engaging in a prohibited transaction. It’s best to wait to remove the property from your IRA until the age of 59 ½ to avoid paying the 10% IRS early-withdrawal penalty fee. That means as long as you do not use the property while it’s still in your IRA account, you can leverage your retirement plan to pay off your future home.

How Can IRAR Help?

With the variety of IRA investment options to consider, planning for retirement can seem like a daunting task. With the right custodian on your side, more REALTORS® can branch out into leveraging alternative assets as part of their retirement plan.

For over 26 years, IRAR has made its mission to provide educational resources that empower our clients to make decisions surrounding alternative investments in IRAs at a lower cost. Don’t delay— retirement is sooner than you think! Set up a free consultation with one of our experts. Find out how a self-directed IRA in real estate can be used to your benefit to secure a richer future for your retirement.

Comments (0)