What's Considered Earned Income for IRA Contributions?

Are you looking for a way to save money on taxes? Are you interested in building wealth to enjoy a life of leisure in your retirement? You can work towards both goals by making contributions to an IRA. To do this, you will need to have earned income. Understanding what is considered earned income and how to make contributions to your account is the first step.

For more than 25 years, IRAR Trust Company has helped investors like yourself understand the ins and outs of making the most of your self-directed IRA. This article will cover everything you need to know when it comes to what is considered earned income.

-

SDIRA 101

-

What is Considered Earned Income

-

What is NOT Considered Earned Income

-

Income Limits for Traditional and Roth IRA

-

Deduction Limits If You ARE Covered by a Retirement Plan at Work

-

Deduction Limits If You ARE NOT Covered by a Retirement Plan at Work

-

How to Make IRA Contributions

Self-Directed IRA 101

A self-directed IRA is all about investing your way. Investing is self-directed, you decide how much to invest and what to invest in by leveraging alternative assets. A self-directed IRA gives investors a unique opportunity compared to a traditional IRA. Regular and managed IRAs really only offer a standard mixed bag of stocks and mutual funds.

With a self-directed IRA, you can invest in alternative assets— from private placements to tax liens, real estate and more. This is especially beneficial for investors with an area of expertise that can be used to make the most out of their return on investments.

Self-directed IRAs help with risk management through greater diversification. Diversification means not putting all your investment funds in one asset class. This type of IRA gives you more control over your investments. Plus, it comes with the same tax benefits as an IRA managed by your traditional IRA providers.

In addition, investors have more advantages such as taking out a non-recourse loan to purchase an investment or partner with others to purchase real estate through their self-directed IRA or personal funds.

Last, you get to decide how you want to conduct asset recordkeeping. Investors have the option to do the bookkeeping themselves through an LLC checkbook control or through the self-directed IRA custodian.

A custodian, like IRAR Trust, is a financial institution that is required by the internal revenue code to hold an account's investments to keep earnings on investments from being taxed. As an added benefit with IRAR’s staff knowledge, you have an advantage by using that knowledge to make sure that all IRS and governmental rules are followed at all times.

Note that although you have the responsibility to make all the decisions when it comes to your self-directed IRA, the IRS still requires a custodians to help protect and maintain the tax-deferred status of your account. They do the reporting and filing to the IRS on your behalf.

What Is Considered Earned Income for IRA Contributions?

Earned income for IRA contributions is usually generated from employment. Earned income may come from:

- Wages

- Salaries

- Tips

- Commissions or bonuses

- Self-employment profits

If you earn income from one of the above sources, you’re in luck! You can take advantage of the wealth-building and tax savings opportunities by making contributions to an IRA. There is no age eligibility to contribute. You just need earned income.

Sometimes the IRS will even consider other types of income to be eligible to make contributions. For students (of all ages), even aid related to graduate or postdoctoral studies might qualify as earned income or individuals receiving difficulty of care payments.

What Is Not Considered Earned Income for IRA Contributions?

Some taxable income is not eligible for an IRA contribution. These streams of revenue do not qualify when it comes to making an IRA contribution:

- Rental property income

- Interest income

- Dividends

- Pension income

- Annuity income

- Capital gains

- Deferred compensation from qualified plans.

Some of these types of incomes are considered passive income. Certain types of financial assistance, such as welfare, unemployment, worker's compensation, and Social Security payments received are not taken into account when calculating earned income.

There are some exceptions. For instance, combat zone compensation received by military members qualifies for earned income to make contributions.

Income Limits for Traditional and Roth IRA Contributions

The amount you can contribute to an IRA each year is limited by the IRS. The IRA 2023 contribution cap is set to $6,500 unless the individual’s income is less than this amount which reduces the maximum to the level of the earned income. For 2022 tax year, the contribution to Roth IRAs and Traditional IRAs cannot exceed $6,000.

Folks that are age 50 or older can make and additional contribution called a catch-up contributions which is an additional $1,000 ($7,500 in total for 2023). If you have both Roth and Traditional IRA, their combined contributions cannot exceed the maximum for the year.

However, when you make contributions (from earned income) to a Roth IRA, you are paying the taxes upfront. This means that you may not pay taxes when taking a distribution at retirement. For a Traditional IRA, the opposite is true. You do not pay the taxes on the earned income being contributed to the IRA. Therefore, you will pay the taxes on this account when you take distributions.

Good recordkeeping will save you headaches down the road. Keep your books in order because your contributions are reported in your tax return. Your IRA custodian will send you a form 5498 with those numbers.

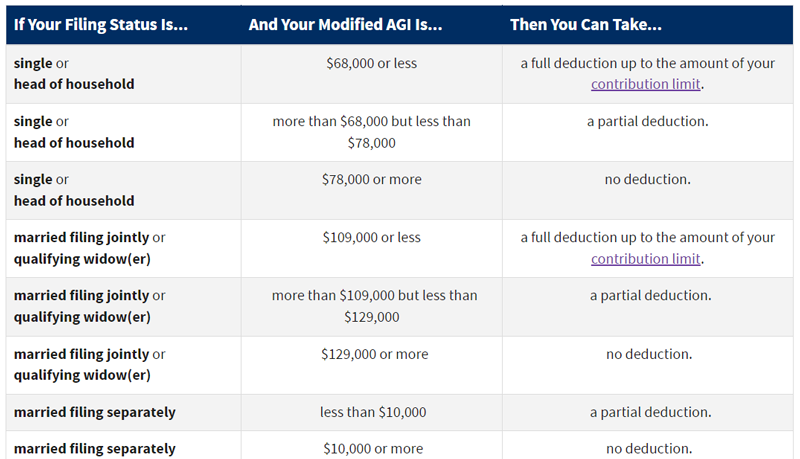

2022 IRA Contribution and Deduction Limits If You ARE Covered by a Retirement Plan at Work

The type of workplace retirement plan you are offered affects the contributions you are able to make. For those who are covered by a workplace retirement plan, the amount you can deduct is directly affected by how much income you earned.

If you are married and file jointly, your Modified Adjusted Gross Income (MAGI) must be under $214,000 for the 2022 tax year and $228,000 for the 2023 tax year. If you file taxes as a single person, your MAGI must be under $144,000 for the 2022 tax year and under $153,000 for the 2023 tax year.

Couples filing separate returns (married filing separately) are only eligible for a partial deduction if their MAGI is less than $10,000.

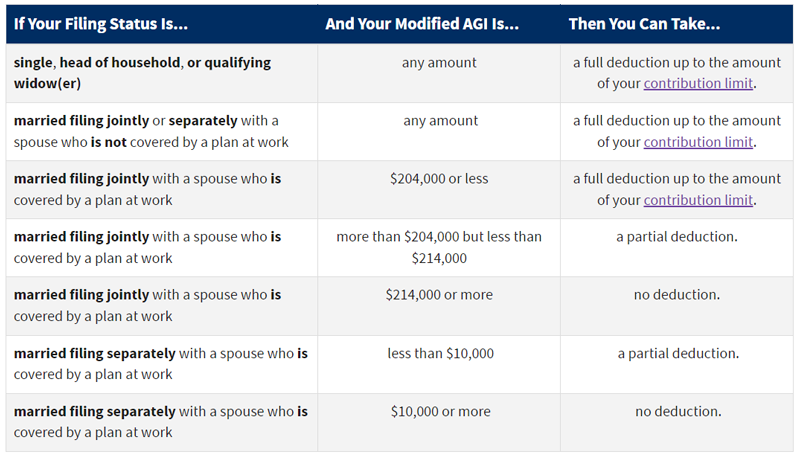

2022 IRA Contribution and Deduction Limits if You are NOT Covered by a Retirement Plan at Work

For those who are not covered by a workplace retirement plan, income is not a limiting factor. As long as it is within the annual limit, any IRA contribution amount are deductible. However, if your spouse is covered by a plan through their employer, there may be a limitation. Nonetheless, the benefits to making a contribution are much greater.

How to Make IRA Contributions with your Earned Income

You're ready to start saving once you establish you have earned income to make IRA contributions. You can easily open an account with IRAR Trust online— just have your ID and a credit card handy when filling out your application.

Next, you’re ready to start making contributions! Simply make a check with the contribution in name of your IRA.

Most importantly, stay within your contribution limit. Otherwise, any excess contributions can be subject to a tax penalty. Avoid the fines by keeping track of your contributions as you make them. Proper record keeping is a must.

Let IRAR Help

Your bottom line is our bottom line when it comes to planning for a more financially secure retirement. From educational resources on alternative investments to lowering fees for your self-directed IRA, IRAR Trust Company is here to support you build wealth intelligently at a lower cost.

Don’t delay the process— opening a self-directed IRA is simple. We are always here to provide a free consultation about opening an account so you can plan for a better, less expensive way to save for retirement.

Comments (0)