4 Tips to Compare Apples to Apples Before Opening a Self-Directed IRA

How much shopping around did you do before buying your latest car, computer, or HDTV?

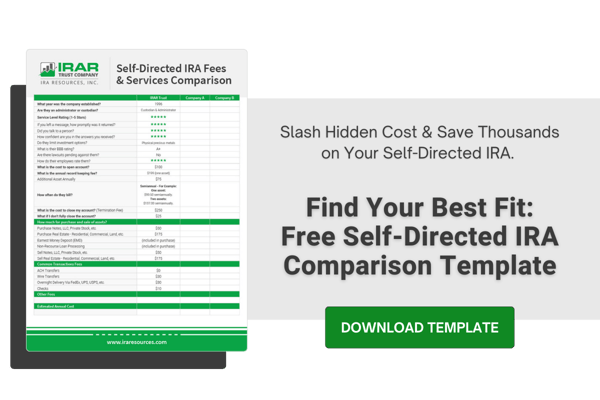

A decision as important as choosing an IRA custodian deserves at least that much research. You’ll want to start by creating a comparison list for Company A and Company B. This lets you compare apples to apples—and to recognize a rotten apple when you see it. Here are some items you’ll want to research and compare:

Fees: How many and how are they charged?

Your list should include the account establishment fee, ongoing administration fees, transaction fees, and termination fees. Find out how these are billed: quarterly, annually, in advance.

Some companies base their annual fees on the value of the account; others offer a fixed annual fee. Which approach is right for you will depend on your investment goals and how much activity you plan in your account.

Reputation: What are other investors saying?

Your retirement savings deserve a secure, reliable IRA provider. Check out the companies’ ratings online. Do they have Yelp reviews? What does the Better Business Bureau have to say about them? Are there any lawsuits pending against them? How do their employees rate them?

Service: Hello? Is anyone there?

When you need to speak to someone is there anyone there to take your call? With technology at your fingertips, you may not need to talk to someone often, but when you do, you should be able to reach a living, breathing, knowledgeable person. Pick up the phone during normal business hours and call the companies you’re researching. If you reach someone, could that person answer your questions? How confident are you in the answers you received? If you left a message, how promptly was it returned? Rate the companies’ service performance on your comparison chart.

Experience: Can they handle your investments of choice?

The IRS puts very few restrictions on the types of investments you can own in a self-directed IRA. But not all providers are familiar with them all. You’ll want to find out if the company limits your investment choices or how you invest. For example, some companies require you to establish an LLC through their services. You don't always need an LLC to make self-directed IRA investments. This is considered a strategy, not a requirement. You also want to find out what are their processing times for an investment purchase. For investments like real estate, the ability to act quickly is important.

Sixteen years ago when I started working in this industry, few people knew what a self-directed was. Nowadays almost everyone has heard of them or has a friend, co-worker, or family member who has one. This increased awareness and demand prompted new companies to enter the space. Some are experienced, others less so.

The only way to tell the difference is by asking questions and making comparisons based on the facts. I hope the tips offered here help with your research. Contact us if you have questions. We promise to answer the phone.

Comments (2)